#04: Sport Tech

Performance tech is being used by sports teams, this isn't news. But can you build a successful business from it?

Before we start, a quick reminder.

I’m Andrew. I was an Olympic athlete, then I moved into building health tech businesses. I’ve built and exited two businesses over the last 10 years: Bootstrapping our first business in 2013 through to acquisition, then helping lead the EMEA half of a global health and diagnostics business through to IPO on the Nasdaq in 2022.

I write in-depth analyses into exciting businesses and technologies at the intersection of sport, health, nutrition and mindset - I call this Human Performance Tech.

Apologies, this edition took a little bit longer than expected to see the light of day, but you know… you’ll survive.

Ok, let’s go.

Sport is the foundry for consumer performance tech

In the pre-Cambrian era, (before the iPhone) cave-dwelling team sport players and hunter-gatherer endurance athletes were wearing primitive things like chest straps to monitor their heart rate, and concealing cumbersome GPS trackers housed in bizarre crop tops. Sometimes they would even exercise in a laboratory, wearing a metabolic cart over their face to measure their VO2 Max, rather than have an app estimate it for them while they consume a greens drink and wait for their smart ring to tell them when they’ve recovered. Crazy times.

But, joke-laden intro paragraph aside, so much of what we consider human performance or health technology today was built for sport.

There’s good reason for this - when everything else is optimised, there’s a viable reason to search for extra hacks to sprinkle some performance fairy dust on top.

So why do we see these technologies inevitably marching down from their hallowed elite peaks towards the untrained masses?

Building a business on elite sports alone is hard.

Let’s say you’re a founder of an unbelievable new kind of smart training tool. Umm… let’s say a new smart insole for football boots.

Your product is legitimately great. It measures not only the traditional wearable biometrics (distance, speed etc), but it also captures detailed bio-mechanic details - think stride frequency, pronation, ground contact time etc. Maybe v2 also captures every ball touch or collision, where on the boot it touched and the intensity of that interaction.

(By the way, there are a few cool companies doing this, check out Plantiga and SportScientia)

You’ve been a sports fan all your life, your dream is that elite Premier League teams would use your technology. Your business grows, and you engage in sales conversations with elite sports teams.

You run into two kinds of decision-makers:

The well-funded, technology-forward head of sports science/elite performance. Their job is to find the tools that may give them an edge. The head coach trusts them and embraces their recommendations. They want real evidence of its utility and accuracy - not just your user feedback survey.

The old-school moody coach. He doesn’t believe in all these ‘computer shoes’. In his day, the best players worked down the mine in the morning, turned up for a match 5 minutes before kickoff, smashed in a half dozen goals then celebrated with the fans at the Dog & Pirate after the game.

Side note. One of my coaches used to describe me in a not dissimilar way - comparing me to “Alf Tupper”, the protagonist of a (real) comic book strip called “Tough of the Track”. Alf would sleep on railway sidings, turn up to the race looking like a vagabond, bang out a gold medal then be off for some fish and chips.

The above description was nearly accurate, I just didn’t have the gold medal

Now you’ve immediately lost ~50% of your addressable market. So you engage in long, price-sensitive sales conversations (often with labour-intensive pilots/trials).

Maybe you close a deal. But maybe the team gets relegated and loses their budget.

Sports teams, by being the pinnacle of so many childhood dreams, are able to control a sales conversation. They know their power, and even in the richest clubs, they reserve their cash for their most expensive outgoing - player salaries.

(One Premier League club I worked with years ago didn't want to pay for both a physiotherapist and a nutritionist, no no. So they asked their physio to do an online nutrition course - problem solved.)

Ironically, this means most sports tech firms only find true revenue by convincing everyday consumers that they also need their technology to change/improve their general health - they become lifestyle and performance technology companies, albeit with an elite sport arm.

Is it possible to actually build a successful, non-consumer sports tech business?

Yes, but it’s not a big market. Here’s the landscape:

Performance tools that are true sport-only businesses

These businesses use technology to help sports teams perform, they focus on selling directly to teams and federations

Performance-adjacent tools for operational or fan-engagement

There’s a lot of cool tech that’s used outside of the direct performance area, but is nonetheless essential in performance sports, such as Hawkeye.

Performance tools that have a use in elite sports, but are really consumer performance businesses with a sports halo effect

Whoop very much took elite sports as a Go-To-Market strategy, striking a deal with the NFL Players Association back in 2017.

We organically took this very approach with DNAFit in our early years. Though we had a pretty active elite sport channel, in reality, the revenue generated was insignificant. It did however open the door for great DTC traction and even led to some surprising B2B contract wins.

There are some, but not many, sports-only tech successes

It is possible(ish).

There are a small handful of genuinely game-changing innovations used in sport, that have either not needed, or not wanted, to go properly downstream.

There are even some who are objectively successful.

Take a look at Catapult Sports (Melbourne, Australia).

They’re known, primarily, for their smart GPS tracker worn in one of those swanky crop tops I mentioned earlier. Since 2006, they’ve built out their product offering and made 3 acquisitions. Now they offer player management and injury prediction SaaS platforms, video analysis software and even a media vertical so clients can monetise their videos for fan engagement and social.

Luckily (and unusually for a sports tech company) Catapult are listed on the Australian Stock Exchange, so the info available through their public filings presents a rare opportunity to uncover the workings of a sports-tech business.

Let’s run through some of their headline figures:

Revenue in 2022 was US$77m (Up from $50m in 2021)

92% of their revenue is from subscriptions with an average annual contract value of ~$60k

>3400 teams use their products, and churn is low. I’m guessing Catapult enjoy some great switching cost power - once you’ve tracked a player’s movement across every training session for a season, you’re pretty unlikely to want to switch to another provider.

(Side thought - I hope they do something clever with this longitudinal data… If a player switches teams, does their historical training data come with them as part of the transaction? If it doesn’t, it should, and Catapult should monetise this transfer service in some way)

But here’s a surprise. I was writing this piece with a preconceived bias that Catapult wasn’t in the consumer game. Then I spotted a reference to this - Catapult One.

They’ve only gone and blown my whole argument apart!

Granted, it’s being marketed only at pretty serious sports people. They call this market the Prosumers market on their annual filing.

Why are Catapult, or others for that matter, going DTC?

1 - There are only so many sports teams in the world. Catapult have a really big slice of the TAM. Where do you go next? There’s nowhere left to go further up, so you have to go down.

2 - I may be wrong, but I think I’m reading their financial statement correctly in that they are EBIT negative to the tune of -$33m in 2022 (compared to -$5m in 2020). That’s a big downward jump since 2020. I suspect Covid was a big hit for them.

If you’re the CEO of Catapult, the factors above rightly conspire to make you try new products, new markets, new strategies. Add in pressure from your investors (CAT.AX share price peaked at $4 in 2016, now they’re trading at under $1 per share) and you’ll find yourself broadening into new sectors pretty quickly.

So even for the best in the sports-only business, it looks like the consumer market is a must, even if it’s an afterthought.

Some other sports-only(ish) tech

StatSports (Newry, UK. Bootstrapped?) do a similar product suite to Catapult, with a strong penetrance in the elite sports market. Interestingly, it’s clear from their website that they are pretty heavily pushing the prosumer DTC route, with “Shop Now” CTA’s clearly above the fold.

Veo (Copenhagen, Denmark. >$100m funding) is a super cool business that has a use case in both consumer and elite sports. Basically, Veo is democratising access to advanced video analysis for everyone from grassroots to elite teams with its impressive smart camera. The clever part here is that this camera also doubles as a super cost-effective way for small clubs to live stream their matches.

Rezzil (Manchester, UK. £1.8m funding) is a VR platform to help sportspeople develop, train and enhance cognitive function and proprioception. They’re fellow Mancunians so I may be biased, but I think it’s absolutely genius. You can use their tech for injury rehab, high-pressure situational training and analysis etc. They also have a consumer version, Rezzil Player 22, which even got a shoutout from Mark Zuckerberg. (Back when he still liked the Metaverse.)

Teamworks (North Carolina, USA. >$160m funding), recently raised their $65m series B. They position themselves as the operating system for sport and have taken a broad approach to covering all sorts of sporting software needs.

Kitman Labs (Dublin, Ireland, >$75m funding) started out as a lab testing provider with a focus on biomarker insights relevant to sports performance, then with some wise strategic moves and acquisitions moved into a full-stack player management offering. Teams I’ve spoken to who are using their service speak very positively about them.

Sport-tech that might find its way downstream

There are few technology avenues that haven’t yet been properly consumerised.

Here’s one prediction - we’ll see more smart Occlusion Training devices.

This is an unpleasant training modality, where you restrict blood flow to a particular muscle or muscle group while performing resistance training. In sport, we used it specifically during injury rehab, and I hated it.

Gym bros like to wear some basic cuffs when working on those biceps, but I can see someone like HyperIce or Therabody bringing a smart cuff to market that tracks, dynamically changes pressure and offers insights via Bluetooth.

I could also imagine seeing more consumer tech options that specialise in biomechanics. I.e. Helping people analyse and improve their technique and movement patterns.

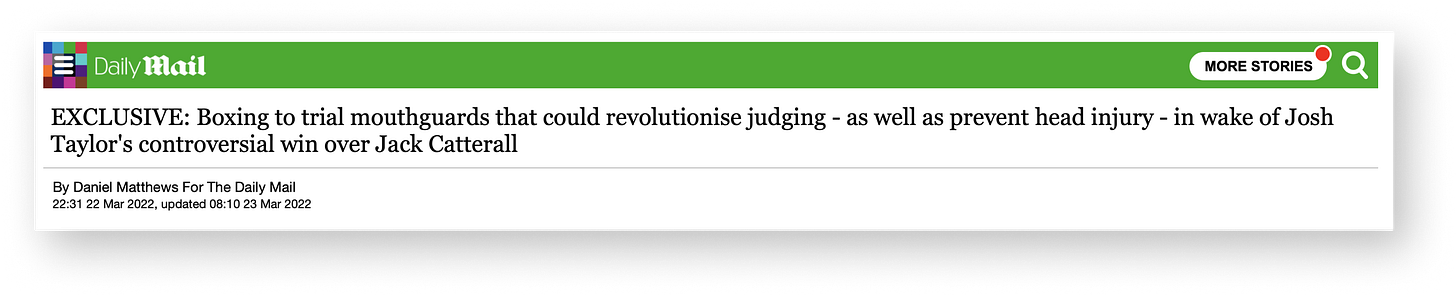

Can wearables fix corruption in sport?

My erstwhile agent mentioned this to me and I thought it was fascinating.

Smart gum shields have an obvious use in tracking metrics such as concussion risk and other biometrics. But in boxing, they can help track point scoring and provide a true assessment of blows landed. In a sport where corruption can, and does, happen - this is a nice positive use case for performance tech.

There’s no reason why we couldn’t see technology enable similar effects to happen in all sports where there’s subjective scoring - I’m looking at you Gymnastics.

Lastly, a request to sporting bodies to innovate in how they use tech

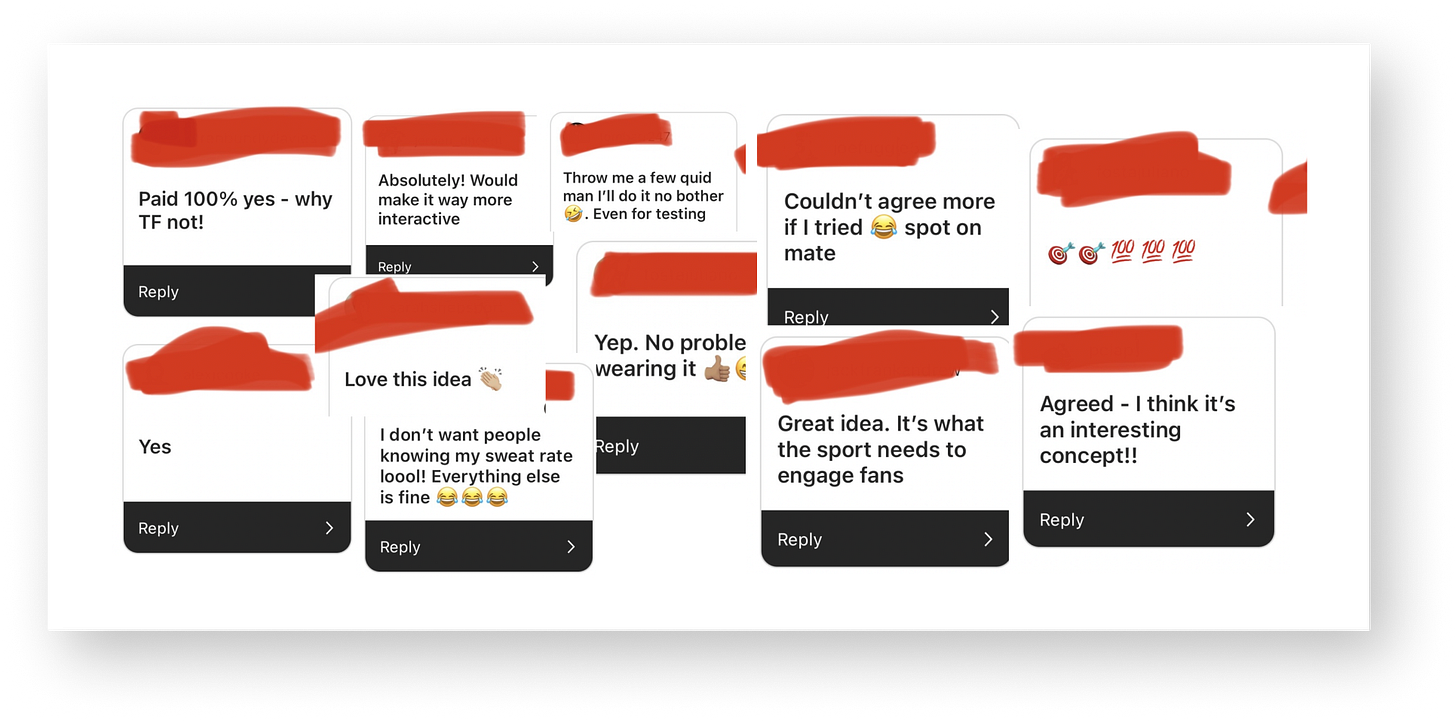

A couple of weeks ago, while I was still a legacy blue tick holder, I write a Twitter thread that kind of blew up.

I was calling on World Athletics to use live biometrics as a fan engagement tool. I.e. endurance athletes are already being asked to wear live distance and speed monitoring chips while racing. Let’s build that out to monitor heart rate, sweat rate, recovery metrics etc.

I see the benefits across a few channels:

Fan engagement & broadcast value add with headline live data

Pro access to your own team’s in-depth data for federations/coaches

Aggregated data for each season available to academic researchers

Even a potential feed for sports betting clients

Share of revenue from any of these streams mandated for all athletes

I surveyed a group of athletes who were overwhelmingly in favour.

This is where the worlds of performance tech, performance-adjacent tech, and consumer health tracking trends can meet.

I think fans would love it, athletes would like it (they need the income) and it would give physiology institutions an incredible dataset to build new innovations.

Wrapping up

As always, thanks for reading. I’d love to hear your thoughts and feedback. If you enjoy these newsletters, I’d really love it if you shared them with your network on whatever platform you see fit.

Anything you’d love me to write up? Let me know.

Until next time, farewell.

Whoop do some live biometrics at events. And F1 have the power to - through sensors in gloves - but they don't want to arm the competition with potentially helpful information.